All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Roth 401(k) payments are made with after-tax payments and after that can be accessed (profits and all) tax-free in retired life. 401(k) plans are developed to assist staff members and company owners construct retired life financial savings with tax benefits plus receive potential company matching payments (totally free added money).

IUL or term life insurance policy may be a requirement if you wish to pass money to successors and do not believe your retirement financial savings will certainly satisfy the goals you have actually defined. This product is intended only as basic details for your ease and should never be taken as investment or tax advice by ShareBuilder 401k.

Chicago Iul

Your economic situation is special, so it's essential to locate a life insurance product that meets your certain demands. If you're looking for life time insurance coverage, indexed universal life insurance coverage is one choice you might intend to take into consideration. Like various other permanent life insurance coverage products, these policies permit you to develop cash worth you can touch throughout your lifetime.

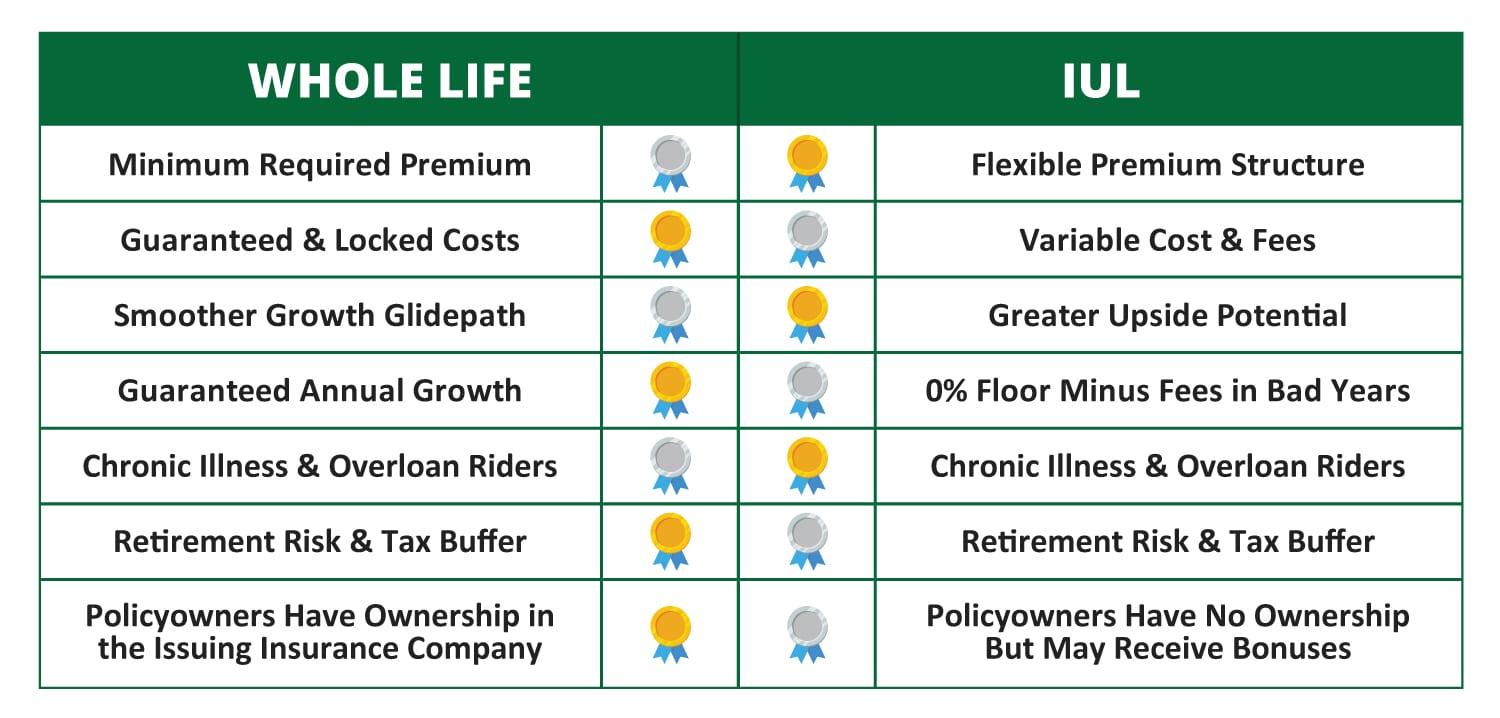

That suggests you have much more long-lasting growth capacity than a whole life policy, which provides a fixed price of return. Yet you likewise experience extra volatility given that your returns aren't ensured. Usually, IUL policies prevent you from experiencing losses in years when the index sheds worth. However, they additionally cover your passion credit history when the index goes up.

As long as you pay the costs, the plan continues to be in pressure for your whole life. You can accumulate cash money value you can utilize during your lifetime for different financial requirements.

Permanent life insurance coverage policies often have higher preliminary premiums than term insurance, so it might not be the best selection if you're on a limited budget plan. The cap on interest credit scores can restrict the upside possibility in years when the securities market does well. Your plan might gap if you secure as well huge of a withdrawal or policy financing.

With the potential for more durable returns and flexible payments, indexed global life insurance policy may be a choice you desire to consider., that can evaluate your personal circumstance and give tailored insight.

Indexed Universal Life Insurance For Retirement

The details and summaries included right here are not intended to be complete summaries of all terms, problems and exclusions applicable to the services and products. The precise insurance policy protection under any nation Investors insurance item is subject to the terms, problems and exemptions in the real plans as released. Products and solutions explained in this site differ from one state to another and not all items, insurance coverages or solutions are readily available in all states.

If your IUL policy has adequate money value, you can obtain against it with adaptable payment terms and reduced passion prices. The alternative to create an IUL plan that shows your particular requirements and situation. With an indexed global life plan, you designate premium to an Indexed Account, thereby producing a Segment and the 12-month Segment Term for that segment starts.

At the end of the sector term, each segment earns an Indexed Credit score. An Indexed Credit rating is determined for a segment if value continues to be in the segment at segment maturity.

These limits are figured out at the beginning of the segment term and are guaranteed for the entire section term. There are four options of Indexed Accounts (Indexed Account A, B, C, and E) and each has a different kind of limitation. Indexed Account A sets a cap on the Indexed Credit scores for a segment.

The development cap will certainly vary and be reset at the start of a section term. The involvement rate determines exactly how much of a rise in the S&P 500's * Index Value applies to segments in Indexed Account B. Greater minimum growth cap than Indexed Account A and an Indexed Account Fee.

Iul Edu Lb

There is an Indexed Account Charge linked with the Indexed Account Multiplier. No matter of which Indexed Account you select, your cash value is always secured from negative market efficiency.

At Segment Maturation an Indexed Credit score is calculated from the adjustment in the S&P 500 *. The worth in the Sector gains an Indexed Debt which is calculated from an Index Growth Rate. That development price is a percent change in the existing index from the start of a Sector until the Sector Maturation date.

Sectors automatically renew for one more Section Term unless a transfer is asked for. Costs obtained considering that the last sweep date and any asked for transfers are rolled right into the same Section so that for any type of month, there will certainly be a single brand-new Sector developed for a given Indexed Account.

Disadvantages Of Indexed Universal Life Insurance

You might not have assumed much regarding how you desire to spend your retired life years, though you probably recognize that you do not desire to run out of cash and you would certainly such as to maintain your existing way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] In the past, individuals relied on 3 major incomes in their retired life: a company pension, Social Security and whatever they 'd handled to save.

And lots of companies have decreased or stopped their retirement strategies. Even if benefits have not been reduced by the time you retire, Social Safety alone was never planned to be sufficient to pay for the lifestyle you want and deserve.

Iul Explained

While IUL insurance coverage might prove important to some, it's essential to understand how it functions prior to buying a plan. Indexed universal life (IUL) insurance plans provide higher upside possible, versatility, and tax-free gains.

As the index moves up or down, so does the price of return on the money value part of your plan. The insurance policy firm that releases the plan might supply a minimum surefire rate of return.

Economic specialists usually advise having life insurance policy coverage that's equivalent to 10 to 15 times your annual revenue. There are several drawbacks related to IUL insurance coverage that movie critics are fast to point out. Someone that establishes the policy over a time when the market is doing poorly could finish up with high premium payments that don't contribute at all to the money worth.

Apart from that, bear in mind the adhering to various other factors to consider: Insurance provider can set involvement rates for just how much of the index return you get annually. As an example, let's say the plan has a 70% participation price. If the index grows by 10%, your cash worth return would certainly be only 7% (10% x 70%).

In addition, returns on equity indexes are typically topped at a maximum quantity. A plan could say your maximum return is 10% each year, regardless of exactly how well the index does. These restrictions can limit the real rate of return that's attributed towards your account every year, no matter just how well the plan's underlying index executes.

IUL plans, on the other hand, deal returns based on an index and have variable costs over time.

Latest Posts

Flexlife Indexed Universal Life

What Is Indexed Universal Life Insurance?

Iul Università